Understanding The Implications Of Increased Bank Reserve Requirements

In the world of finance, banks play a pivotal role in maintaining economic stability. When regulations change, particularly those concerning reserve requirements, the ripple effects can be profound. Reserve requirements dictate how much money banks must hold in reserve against their deposits, influencing their ability to lend and invest. As banks are required to hold more money in reserve, various consequences unfold, affecting everything from lending practices to the larger economy. This article delves into the intricacies of what happens when a bank is required to hold more money in reserve and the implications it has on both consumers and the financial system.

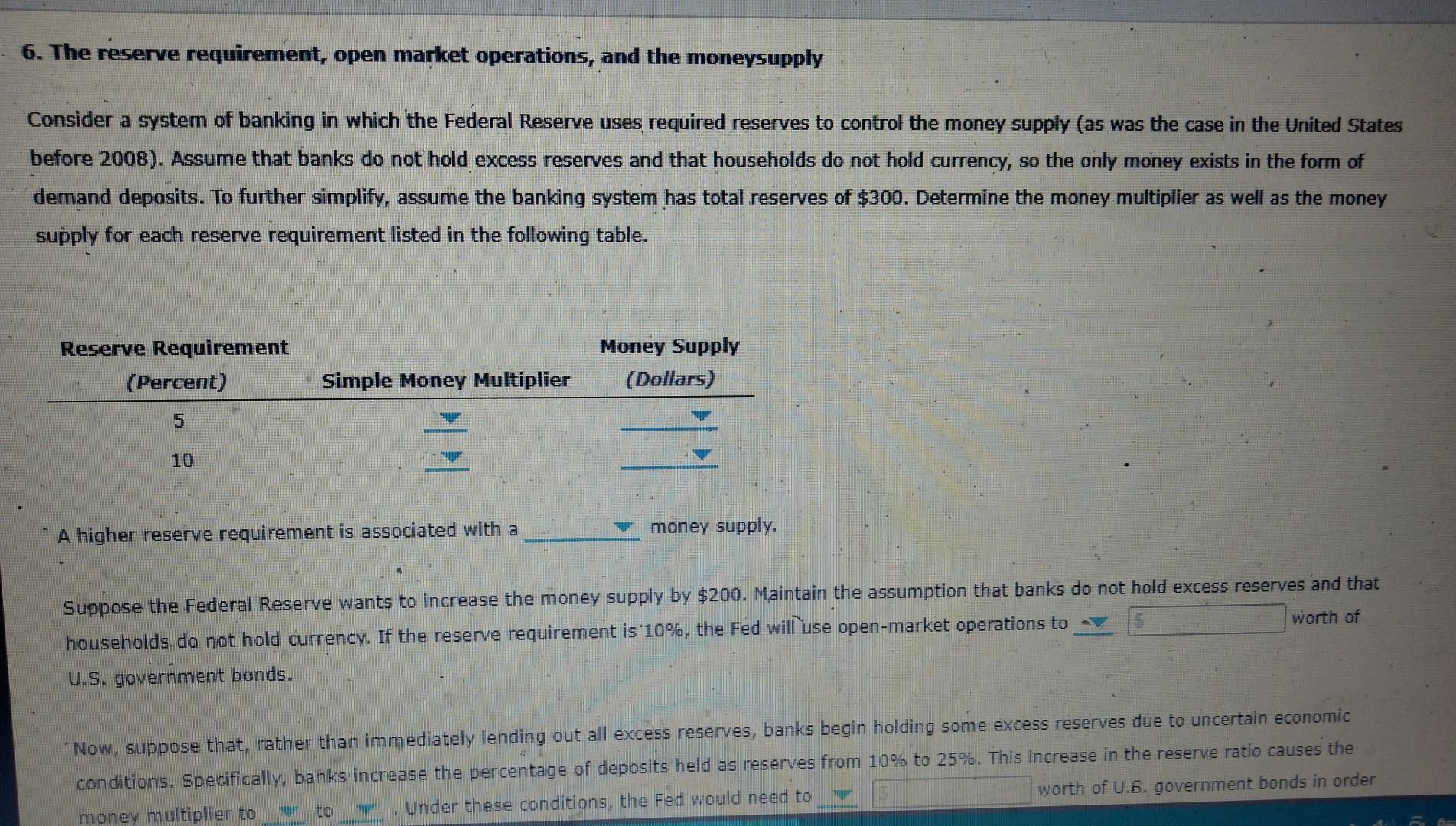

Understanding the dynamics of reserve requirements is crucial for grasping how monetary policy shapes economic activity. When banks hold more reserves, they have less available for loans, which can lead to tighter credit conditions. This tightening can influence interest rates, consumer spending, and overall economic growth. The balance between maintaining sufficient reserves and fostering lending activities is a delicate one that regulators constantly navigate.

As we explore the question of what happens when a bank is required to hold more money in reserve, we will examine various aspects including the reasons behind such requirements, their effects on the banking system, and their broader implications for the economy. Join us as we uncover the layers of this complex financial topic.

What Are Bank Reserve Requirements?

Bank reserve requirements refer to the minimum amount of funds that a bank must hold in reserve against deposits made by customers. This reserve is typically kept in the bank's vaults or at the central bank. Reserve requirements are a tool used by central banks to control the money supply and ensure financial stability.

Why Are Reserve Requirements Increased?

Central banks may increase reserve requirements for several reasons, including:

- To combat inflation by reducing the money supply.

- To strengthen the banking system by ensuring banks have enough liquidity to meet withdrawals.

- To stabilize the economy during periods of uncertainty or economic volatility.

How Do Increased Reserve Requirements Affect Lending Practices?

When banks are required to hold more money in reserve, their ability to lend decreases. This can lead to a number of consequences:

- Higher interest rates for borrowers.

- Reduced availability of loans for consumers and businesses.

- Potential slowdowns in economic growth due to reduced spending.

What Happens to Interest Rates When Reserve Requirements Increase?

One of the immediate effects of increased reserve requirements is a potential rise in interest rates. Banks pass on the cost of holding additional reserves to consumers in the form of higher borrowing costs. This can create a ripple effect throughout the economy.

Can Consumers Expect Tighter Credit Conditions?

Yes, consumers can expect tighter credit conditions when banks are required to hold more money in reserve. This tightening can manifest in several ways:

- More stringent credit checks for loan applicants.

- Decreased loan limits for individuals and businesses.

- Increased fees associated with loan applications and processing.

What Are the Long-Term Implications for the Economy?

The long-term implications of increased reserve requirements can vary. While they may strengthen the banking system in the short term, they can also lead to:

- Slower economic growth due to reduced lending.

- Potential increases in unemployment if businesses cannot secure financing.

- Challenges for consumers seeking credit for major purchases.

How Do Banks Adjust to Increased Reserve Requirements?

Banks employ various strategies to adjust to increased reserve requirements, including:

- Reducing the volume of loans issued.

- Raising interest rates to maintain profitability.

- Increasing fees for banking services.

What Can Be Done to Mitigate Negative Effects?

To mitigate the negative effects of increased reserve requirements, policymakers can consider:

- Implementing measures to encourage lending, such as lower interest rates.

- Providing support for small businesses to access credit.

- Offering incentives for banks to maintain lending levels despite higher reserve requirements.

Conclusion: The Balance of Reserve Requirements

In conclusion, understanding what happens when a bank is required to hold more money in reserve is essential for grasping the broader economic implications. Increased reserve requirements can lead to tighter credit conditions, higher interest rates, and potential slowdowns in economic growth. However, with careful management and appropriate policy measures, the adverse effects can be mitigated, ensuring that banks remain stable while still supporting economic activity.

ncG1vNJzZmixn6PAtr7IZqWeq6RjsLC5jq2pnqaUnruogY6wn5qsXZ2usbzEp6pmr5iau26tjJuYp6NdnsBuvsSqrKKqlZl6tbuMoaalnF2ivLOxjKamp52pYravedGeqp6qppp6qsCMoZisZpipuq0%3D