Effective Depreciation Methods For Projected Cash Flow In A Plant Over Ten Years

In today's financial landscape, understanding how to manage assets efficiently is paramount for businesses, especially for those operating manufacturing plants. One of the key components in this asset management strategy is the depreciation method. This method not only affects the company's financial statements but also plays a crucial role in predicting expected cash flows over the lifespan of the asset. By grasping the intricacies of various depreciation methods, plant managers can make informed decisions that impact their financial health. In this article, we will explore the depreciation method over the ten years of expected cash flow for a plant, highlighting its significance and implications.

As organizations invest significantly in plant infrastructure, it becomes imperative to accurately account for the wear and tear of machinery and equipment. This accounting practice, known as depreciation, allows businesses to allocate costs over the useful life of an asset. By linking depreciation to expected cash flow, managers can forecast their financial positions more reliably, thus enhancing decision-making processes. This synergy between depreciation and cash flow is essential for maintaining a healthy bottom line and ensuring sustainable growth.

Moreover, the choice of depreciation method can have varying impacts on tax liabilities and cash flow projections, ultimately influencing a plant's operational strategy. Different methods such as straight-line, declining balance, and units of production offer distinct advantages and disadvantages. Understanding these methods is crucial for plant managers seeking to optimize their financial strategies and enhance their investment decisions. In the following sections, we will delve deeper into these depreciation methods and evaluate their effects on expected cash flow over a ten-year horizon.

What Are the Different Depreciation Methods?

Depreciation can be calculated through various methods, each having its own implications on financial reporting and cash flow management. The most common methods include:

- Straight-Line Depreciation: This method spreads the cost of the asset evenly across its useful life.

- Declining Balance Depreciation: This method accelerates depreciation, allowing for higher deductions in the early years.

- Units of Production Depreciation: This method bases depreciation on the actual usage of the asset.

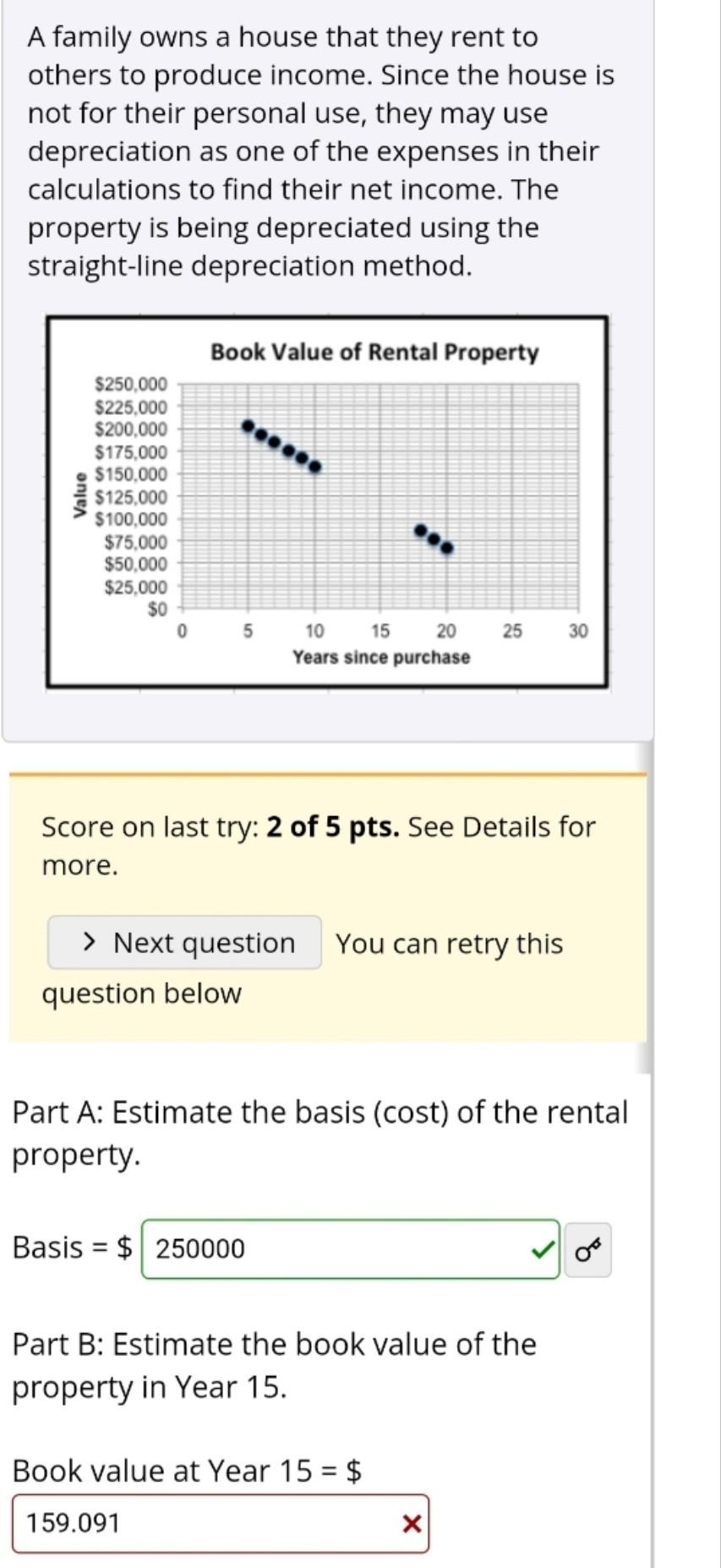

How Does Straight-Line Depreciation Work?

Straight-line depreciation is one of the simplest and most widely used methods. Here’s how it operates:

To calculate straight-line depreciation, you need to know three key figures:

- Initial Cost: The purchase price of the asset.

- Salvage Value: The estimated value of the asset at the end of its useful life.

- Useful Life: The duration over which the asset is expected to be utilized.

The formula to calculate annual depreciation expense is:

Annual Depreciation = (Initial Cost - Salvage Value) / Useful Life

What Are the Benefits of Straight-Line Depreciation?

Utilizing straight-line depreciation has several advantages:

- Simple to calculate and apply.

- Provides a consistent annual expense that aids in budgeting.

- Aligns well with the cash flow generated by the asset.

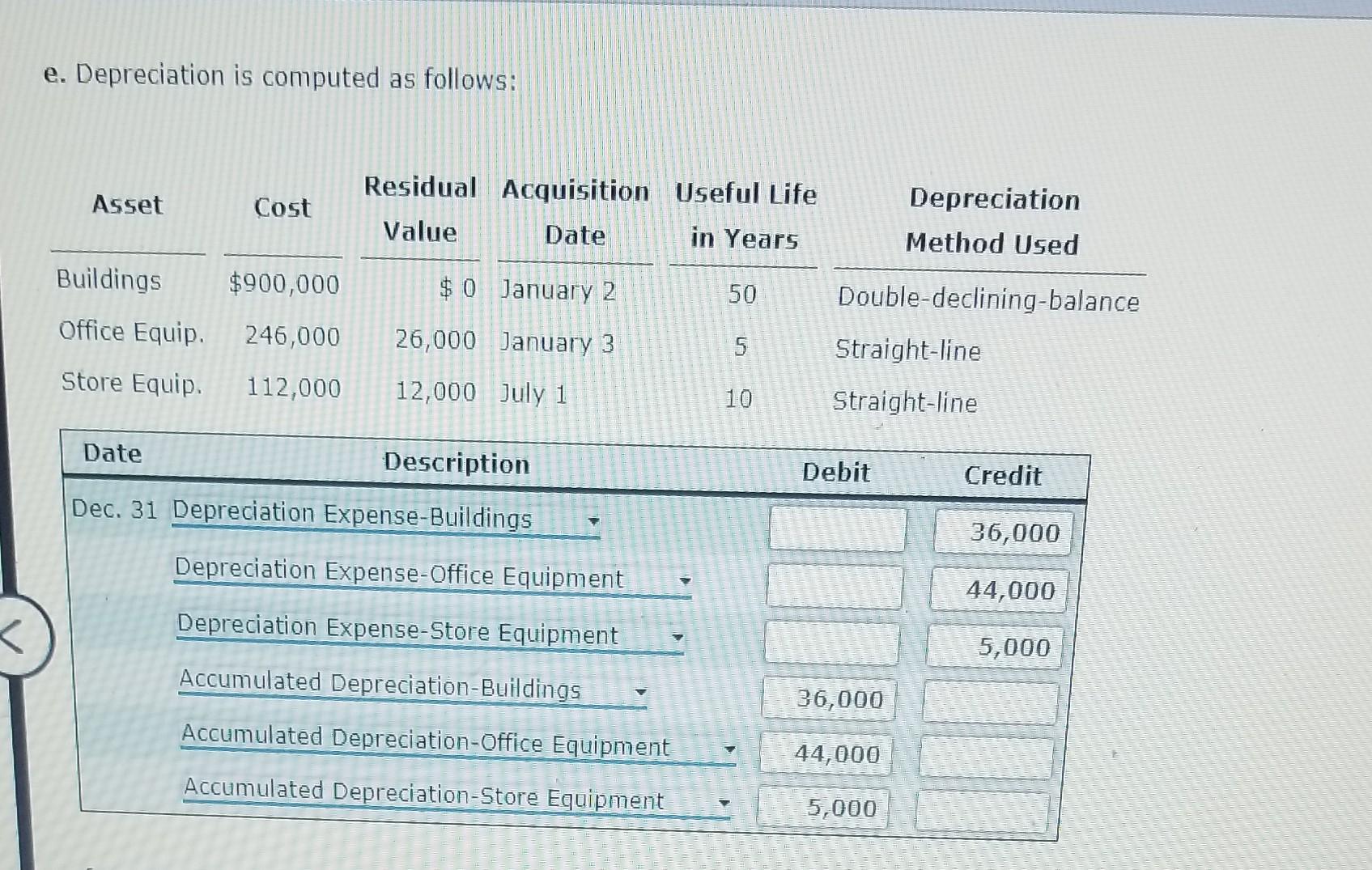

What Is Declining Balance Depreciation?

Declining balance depreciation is an accelerated depreciation method that allows for larger deductions in the earlier years of an asset's life. This can be particularly beneficial for assets that lose value quickly or become obsolete faster than anticipated.

How Is Declining Balance Depreciation Calculated?

To apply the declining balance method, you typically use a formula that involves a depreciation rate. The calculation follows these steps:

- Determine the depreciation rate (often double the straight-line rate).

- Apply the rate to the remaining book value of the asset each year.

The formula for the first year’s depreciation expense is:

Depreciation Expense = Book Value x Depreciation Rate

What Are the Advantages of Using Declining Balance Depreciation?

Some benefits of the declining balance method include:

- Larger tax deductions in the early years improve cash flow.

- Reflects the actual decline in value for many types of assets.

- Encourages reinvestment in newer technologies due to accelerated write-offs.

How Does Units of Production Depreciation Function?

The units of production method ties depreciation to the actual usage of the asset rather than time. This is particularly useful for machinery in manufacturing plants where wear and tear is directly related to production levels.

What Variables Are Needed for Units of Production Depreciation?

To calculate depreciation using this method, you need:

- Total Estimated Production: The total units the asset is expected to produce over its life.

- Actual Production: The number of units produced in a given year.

The formula is as follows:

Depreciation Expense = (Cost - Salvage Value) / Total Estimated Production x Actual Production

What Are the Pros and Cons of Units of Production Depreciation?

Advantages of this method include:

- Depreciation expense aligns with actual usage, providing a more accurate reflection of wear and tear.

- Can be beneficial for budgeting and forecasting purposes.

However, it also has its downsides:

- Requires accurate tracking of production levels.

- Can be complex to manage if production levels fluctuate significantly.

How Do Depreciation Methods Affect Cash Flow?

Understanding the interplay between depreciation and cash flow is crucial for plant managers. The choice of depreciation method can significantly impact financial projections and tax obligations, ultimately affecting cash flow. Here are some considerations:

- Accelerated methods can improve cash flow in the short term by providing larger tax deductions.

- Straight-line depreciation offers predictability in expenses, aiding in long-term budgeting.

- Units of production method allows for flexibility based on actual performance and usage.

Is It Possible to Change Depreciation Methods Over Time?

Yes, businesses can change depreciation methods, but it must be justified and documented. The change should reflect a more accurate representation of the asset's usage or economic reality.

What Factors Should Influence the Choice of Depreciation Method?

When choosing a depreciation method, consider:

- The nature of the asset and its expected usage.

- Financial reporting requirements and tax implications.

- Cash flow needs and overall business strategy.

Conclusion: Making Informed Decisions on Depreciation

In conclusion, the depreciation method over the ten years of expected cash flow for a plant is a critical consideration that can significantly influence financial health. By understanding the different methods available—straight-line, declining balance, and units of production—managers can choose the best strategy that aligns with their operational needs and financial goals. Ultimately, the right depreciation method can not only enhance cash flow but also support long-term sustainability and growth for the plant.

ncG1vNJzZmixn6PAtr7IZqWeq6RjsLC5jq2pnqaUnruogY6dnKmqlZi2osDIqKVmpZWptbCwjKitnqpdqbWmedOepWaxlZa%2FtHnOn2SesKCasLWxw2aamquYYrOtu9Zmq6GdXaW5orrTZ5%2BtpZw%3D